Asaan Karobar Finance Scheme Online Registration

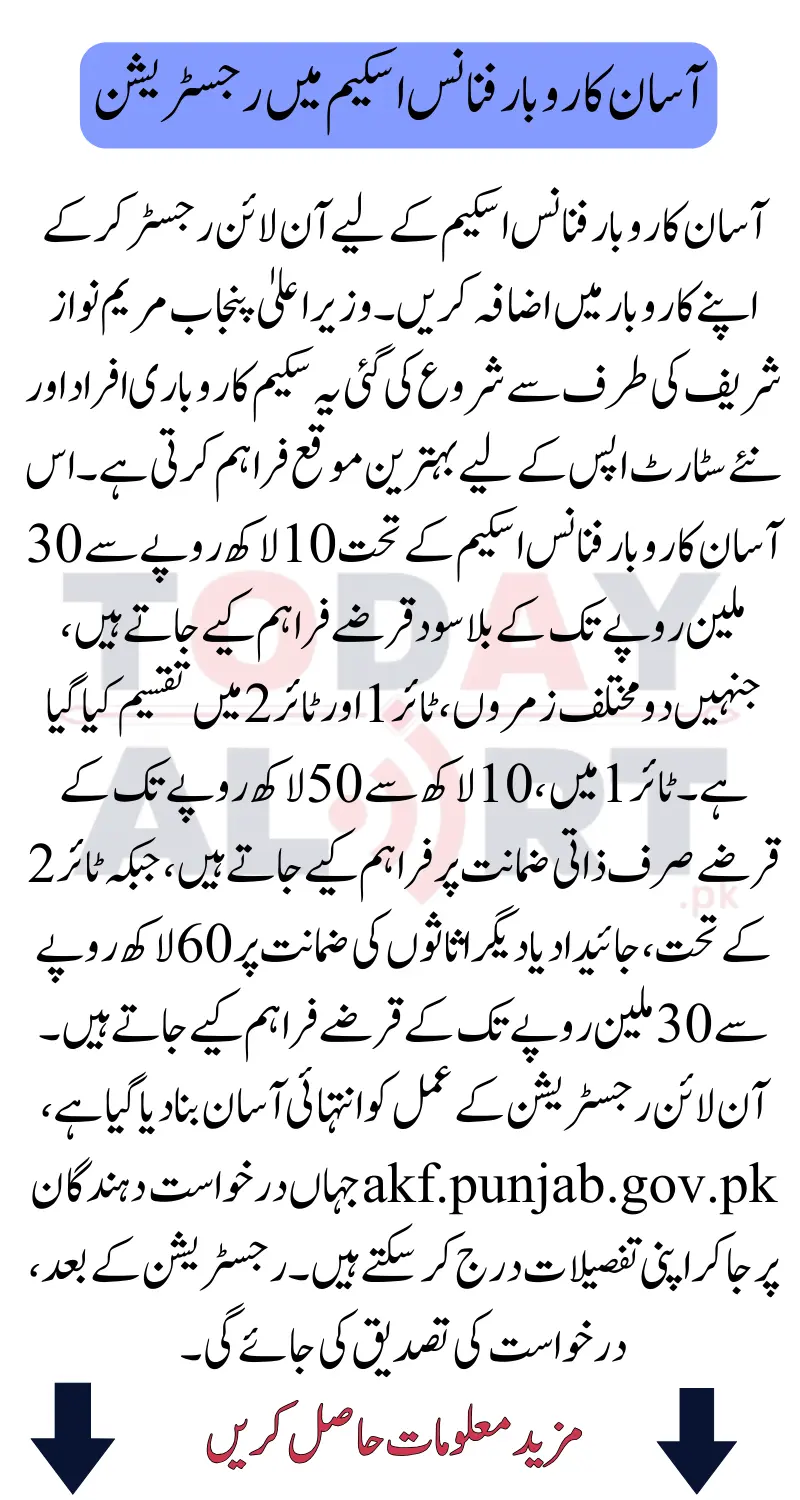

Grow your business by registering online for the Asaan Karobar Finance Scheme. Launched by Punjab Chief Minister Maryam Nawaz Sharif, this scheme provides a great opportunity for entrepreneurs and new startups. Under this Asaan Karobar Finance Scheme, interest-free loans ranging from Rs 1 million to Rs 30 million are provided, which are divided into two different categories, Tier 1 and Tier 2. In Tier 1, loans of Rs 1 million to Rs 5 million are provided only on personal guarantee, while under Tier 2, loans of Rs 6 million to Rs 30 million are provided on the guarantee of property or other assets.

The online registration process has been made extremely easy, where applicants can visit akf.punjab.gov.pk and enter their details. After registration, the application will be verified, and the loan will be released by the Bank of Punjab. There are also special incentives for women, disabled people, and transgender people under this scheme, such as only a 10 percent equity contribution requirement.

This scheme will not only be helpful for those starting new businesses but will also provide an opportunity to modernize and expand existing businesses. If you are a permanent resident of Punjab and meet the prescribed conditions, then this scheme is a golden opportunity for you. Apply online now and turn your business dream into a reality. In this article, we will guide you through the objectives of the scheme, eligibility criteria, loan details, and the step-by-step process to register online.

Objectives of the Asaan Karobar Finance Scheme

The Asaan Karobar Finance Scheme is aimed at empowering individuals and businesses in Punjab. Its key objectives include:

- Supporting Startups: Offering initial funding to help new businesses get off the ground.

- Expanding Existing Businesses: Facilitating growth, modernization, and diversification of established enterprises.

- Promoting Climate-Friendly Businesses: Encouraging sustainable and environmentally friendly practices.

- Creating Job Opportunities: Generating employment across various industries to reduce unemployment in Punjab.

This initiative reflects the government’s commitment to fostering entrepreneurship and driving economic progress in the province.

Read more: Honhar Laptop Scholarship Increase Laptop Distribution from 40,000 to 100,000 Students

Who is eligible for Asaan Karobar Finance Scheme

To apply for the Asaan Karobar Finance Scheme, you must meet the following requirements:

- You must be a permanent resident of Punjab.

- Applicants must be between 25 and 55 years old.

- You must be an active tax filer registered with the Federal Board of Revenue (FBR).

- Small enterprises with annual sales up to PKR 150 million are eligible

- Medium enterprises with annual sales between PKR 150 million and PKR 800 million can also apply.

- Both your business and residence must be in Punjab.

- You will need your CNIC, NTN (National Tax Number), and proof of business ownership or lease.

Read more: How Many Methods To Complete Your Registration in Punjab Negahban Ramadan Program Via PSER Survey

Loan Details and Categories for Asaan Karobar Finance Scheme

The loans are categorized into two tiers based on the amount:

Tier 1 :

- Loan Amount: PKR 1–5 million.

- Security: Only a personal guarantee is required; no collateral is needed.

- Processing Fee: PKR 5,000.

- Tenure: Repayable over up to 5 years.

- Interest Rate: Completely interest-free.

Tier 2 :

- Loan Amount: PKR 6–30 million.

- Security: Collateral such as property or assets is required.

- Processing Fee: PKR 10,000.

- Tenure: Repayable over up to 5 years.

- Interest Rate: Completely interest-free.

Both tiers offer financial support without imposing a financial burden on borrowers, making it an attractive option for entrepreneurs.

Also read: How to Check 8171 BISP 13500 New Payment January to March Online Via Web Portal

Step-by-Step Online Registration Process

Registering for the Asaan Karobar Finance Scheme online is a straightforward process. Follow these steps to apply:

- Visit the Official Website: Go to akf.punjab.gov.pk.

- Login or Register: If you are a new user, click on the “Register Now” button or Existing users can log in using their username and password.

- Fill Out the Profile Registration Form: Provide accurate information, including:

- Name (as per your CNIC).

- Father’s or husband’s name.

- CNIC number, email address, and contact details.

- Residential address, including province, division, district, and tehsil.

- Business details, including NTN and ownership status.

- Set Your Password:

Create a secure password and click “Register.” - Verify Your Email:

A verification email will be sent to your registered email address. Click the link in the email to activate your account. - Log In to Your Account:

Use your CNIC and password to log in to the portal. - Complete Your Application:

- Click on “New Application.”

- Provide detailed information about your business, including land, profits, and other required details.

- Submit Your Application:

After completing the form, submit your application for verification.

Once verified, the Bank of Punjab will issue your loan.

Loan Disbursement and Repayment Details

After receiving the CM Punjab Asaan Karobar Card, the loan will be disbursed in two phases:

- First 50% of the Loan:

- Available within the first 6 months of receiving the card.

- Ensure responsible usage and timely repayments to access the second half.

- Second 50% of the Loan:

- Available upon verification of responsible usage of the first half and registration with PRA/FBR.

Grace Period:

- Startups: Up to 6 months before repayment begins.

- Existing Businesses: Up to 3 months.

Repayment Terms:

- Minimum of 5% of the outstanding balance must be repaid monthly.

- Loans are repayable over 24 equal monthly installments.

Usage Restrictions:

- The loan must be used exclusively for business purposes. Personal expenses are not allowed.

Also read: CM Maryam Nawaz Announced to Start Registration in Asaan Karobar Card Program 2025

Benefits of the Scheme

The Asaan Karobar Finance Scheme offers several benefits to applicants, including:

- Interest-Free Loans: Borrow without worrying about high interest rates.

- Inclusive Program: Special concessions for women, transgender individuals, and differently-abled persons.

- Climate-Friendly Businesses: Additional incentives for sustainable business practices.

- Streamlined Online Application: Simple and user-friendly registration process.

- Economic Growth: Contributes to job creation and the overall economy of Punjab.

Common Mistakes to Avoid

To ensure a smooth application process, avoid the following mistakes:

- Incomplete Documents: Double-check that all required documents are submitted.

- Incorrect Information: Ensure the accuracy of your CNIC, contact details, and email address.

- Missed Deadlines: Submit your application on time to avoid delays.

Also read: Apply Now: Maryam Nawaz Honhar Laptop Scheme Details Revealed in 2025

Additional Charges and Conditions for Asaan Karobar Finance Scheme

While the loans are interest-free, there are some charges to consider:

- Annual Card Fee: PKR 25,000 + FED.

- Late Payment Fees: Charged as per the bank’s policy.

- Verification and Registration: Physical verification of your business premises and registration with PRA/FBR is mandatory within 6 months.

Read more: Free Laptops for Students: Highlights of the PM Laptop Scheme 2025

Conclusion

The Asaan Karobar Finance Scheme is a groundbreaking initiative that provides financial support to businesses in Punjab. With interest-free loans, a simple online application process, and support for startups and existing businesses, this scheme is an excellent opportunity for entrepreneurs to grow their ventures.

If you meet the eligibility criteria, do not miss this chance to apply. Follow the registration steps, prepare your documents, and secure your business funding today. Together, let’s contribute to the economic prosperity of Punjab.

FAQs

What is the loan amount offered under the Asaan Karobar Finance Scheme?

The scheme offers loans ranging from PKR 1 million to PKR 30 million, divided into two tiers.

Who can apply for the Asaan Karobar Finance Scheme?

Permanent residents of Punjab aged 25–55 years who are active tax filers and have a valid business are eligible.

Is there an interest rate on the loan?

No, the loans are completely interest-free.

How can I register for the scheme?

Visit akf.punjab.gov.pk and follow the registration steps mentioned above.

Are there any special benefits for women or differently-abled persons?

Yes, they are required to contribute only 10% equity for loans, compared to 20% for others.